For many childcare businesses and preschools that have been struggling financially, loans and grants can be welcome sources of supplemental funding. While the application process for loans and grants can be time-consuming, the financial cushion from extra funding makes it well worth the effort! With patience and persistence (and a bit of paperwork), you can access funding from federal, state, local, and corporate sources to help bolster your center’s finances.

In this guide, we’ll cover how to find and apply for small business loans and grants for your early education center. What’s included:

Loans vs. grants: which is right for your childcare business?

Paycheck Protection Program (PPP) loans for childcare businesses

Where to find other childcare loans and grants

Tips for successfully applying for a loan for your childcare center

Loans vs. grants: which is right for your childcare business?

In the simplest terms, loans must be repaid, and grants do not. Both sources of funding can provide valuable financial relief for your business, whether you’re suffering a financial loss, considering expanding your business, or simply keeping the lights on.

Loans are administered by banks, credit unions, or online lenders, and they are repaid over a certain period of time with interest.

Grants are given by government organizations, foundations, or corporations. While they do not need to be repaid, there are usually stricter criteria on who can receive funding and how the funding can be spent. Grants are often only available for a certain period of time, and it can take longer to be approved and receive funding than it does with a loan.

In the wake of COVID-19, more loan and grant programs have opened up to help small businesses stay afloat during this challenging time.

Paycheck Protection Program (PPP) loans for childcare businesses

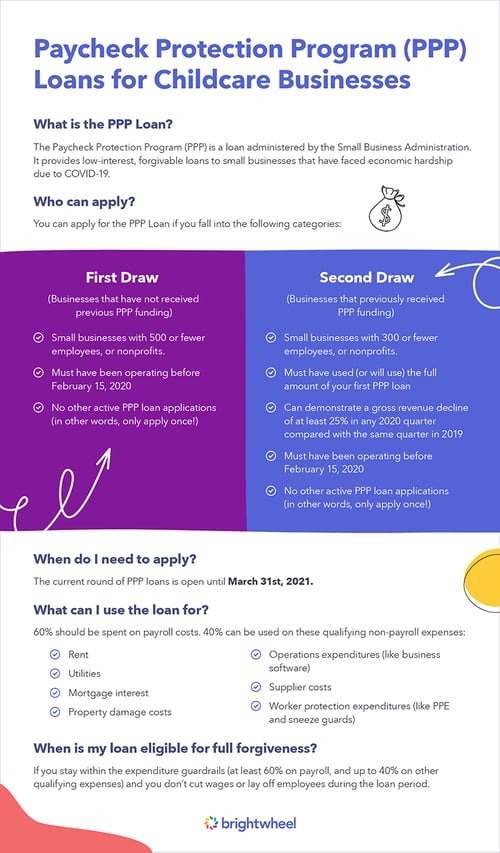

The Paycheck Protection Program (PPP) is a loan program administered by the Small Business Administration. It aims to provide low-interest, forgivable loans to small businesses that have faced economic hardship due to COVID-19.

What childcare providers need to know about PPP loans

PPP loans are issued through individual lenders, from big banks to credit unions to online lenders. The current round of PPP loans is open from January 13, 2021 to May 31, 2021.

These loans include simple terms:

-

- Fixed interest rate of 1%

- Payments can be deferred for six months to one year from the origination of the loan

- Maximum loan term of two years (varies from lender to lender)

- No collateral is required

Most importantly, these loans are eligible for partial or total forgiveness.

Who can apply

PPP loans are intended for small businesses that have lost revenue due to COVID-19.

There are two categories of applications:

- 1. First draw. This is for businesses that didn’t receive funding through PPP previously.

- 2. Second draw. This is for businesses that previously received PPP loans.

- For first draw applications, these are the requirements:

-

- Small businesses with 500 or fewer employees, or nonprofits. There are also a few other categories of businesses that qualify for PPP loans, but they are unlikely to apply to most childcare centers and preschools.

- Must have been operating before February 15, 2020

- No other active PPP loan applications (in other words, only apply once!)

- Not in a disqualified category such as businesses that have over 20% ownership by China. This is highly uncommon for most childcare businesses.

For second draw applications, the requirements are slightly different:

-

- Small businesses with 300 or fewer employees, or nonprofits. (Note that this is a smaller number of employees than first draw applications!)

- Must have used (or will use) the full amount of your first PPP loan

- Can demonstrate a gross revenue decline of at least 25% in any 2020 quarter compared with the same quarter in 2019

- Must have been operating before February 15, 2020

- No other active PPP loan applications (in other words, only apply once!)

In addition to these standard requirements, your individual lender may have requirements as well. This can include good credit history (often, borrowers must meet the SBA standard minimum credit score requirement of 620-640) and how necessary the funding is (based on your payroll forecast and “compelling reasoning”).

The amount you can apply for

The amount you can apply for is your average total monthly payroll costs during the year prior, multiplied by 2.5. (But this amount can’t exceed $10 million.)

“Payroll costs” doesn’t just mean wages. It includes:

-

- Salaries, wages, and tips

- Vacation, family, medical or sick leave payments

- Group health insurance premiums

- Retirement benefits

- Employee costs such as remote tools, equipment, transportation, etc.

What to use the loan for

The purpose of the PPP is to cover payroll expenses, but there’s wiggle room for other necessary business costs.

To qualify for loan forgiveness, at least 60% of the loan should be spent on payroll costs.

That leaves up to 40% of the loan that can be used on qualifying non-payroll expenses, including:

-

- Rent

- Utilities

- Mortgage interest

- Property damage costs

- Operations expenditures (like business software)

- Supplier costs

- Worker protection expenditures (like PPE and sneeze guards)

Loan forgiveness

Your PPP loan is eligible for full forgiveness if:

-

- You stay within the expenditure guardrails (at least 60% is spent on payroll costs, and up to 40% may be spent on other qualifying expenses)

- You don’t cut wages or lay off employees during the loan period

Don’t worry—if you don’t meet these requirements, you can still qualify for partial forgiveness! If you do have to lay off employees, you can divide the actual average employee total by the predicted employee total to get a percent.

A partial loan forgiveness example:

Imagine this common scenario. A business owner predicted she would have 10 staff members when she applied for her loan. In the first month, she kept all 10 staff members. Unfortunately, things took a turn for the worse in the second month and she had to let 2 of them go.

We’ll add the total number of staff members she had in each of the 2 months. 10 + 8 = 18.

Then we’ll divide it by 2 to get the average number of employees for those 2 months. 18 / 2 = 9.

Finally, we’ll divide the average (9) by the predicted number (10) to get a percentage. 9 / 10 = 90%.

That means this business owner is eligible for partial forgiveness of 90% of her eligible expenses.

In order to get your loan forgiven, you must apply for loan forgiveness. (It doesn’t happen automatically!) The SBA has forms for you to fill out to apply for forgiveness. Be prepared to provide your payroll records, expenditure receipts, and mortgage statements. Loans of $150,000 or less use a simplified forgiveness form, but still have to meet forgiveness eligibility. Your individual lender may have additional requirements or documentation, so be sure to ask if you have questions about anything!

How to apply for a PPP loan for your childcare business

The application may seem daunting, but there are really only a few steps you need to take in order to prepare and submit your application.

1. Find a lender approved by the SBA at www.sba.gov.2. (Optional, but encouraged) View sample applications on the SBA website. First draw sample applications are here and second draw sample applications are here.

3. Gather your required paperwork. It’s very helpful to do this before you start your application! Here is what you’ll need:

-

- Profit and loss statement from last fiscal year

- Payroll costs for the last fiscal year

- Projected payroll costs for 2021 (based on your budgets and forecasts)

- Tax returns from 2020 and 2019

- Your SBA loan number from your first PPP loan (if applicable)

- Your individual lender may require additional documentation. Keep your business plan, legal company formation documents, and other financial documents handy.

4. Apply through your lender. This is usually done online.

5. Follow up if needed. Your lender has 10 days to process your loan. It never hurts to check in and stay in touch throughout the process.

If you've already received your PPP loan, our tracking spreadsheet can help you organize your expenses for a smoother loan forgiveness process!

Download our free PPP loan tracking spreadsheet for childcare and preschool businesses here!

Where to find other childcare loans and grants

In addition to PPP loans, childcare providers should also consider applying for the COVID-19 EIDL (Economic Injury Disaster Loans). This program provides economic relief to small businesses and non-profit organizations that are currently experiencing a temporary loss of revenue due to the pandemic. This low-interest loan can be used to cover working capital and normal operating expenses, such as rent and utilities. If your program is located in a low-income community and you can demonstrate a reduction in revenue of more than 30%, you may also be eligible for additional funds through the Targeted EIDL Advance grant. You don’t need to submit a separate application for the Targeted EIDL Advance, as the SBA will automatically reach out to all EIDL applicants who qualify. Apply for the EIDL program here.

Through the December 2020 COVID-19 relief package, the Child Care & Development Block Grant (CCDBG) also received $10 billion in funding to help childcare providers cover additional operational costs associated with COVID-19. Since CCDBG funding will be distributed by individual state agencies, reach out to your local CCR&R agency to learn more about what grants are available and accepting applications.

The following online resources can also help you find additional small business funding opportunities that your center may qualify for:

-

- Grants.gov: This is the official database for grants issued by the government.

- Small Business Development Centers (SBDC’s): Your local SBDC can help you find financing and networking opportunities.

- Child Care Resource & Referral (CCR&R) agencies: As mentioned above, your local CCR&R agency can help connect you with resources and financial assistance for your childcare program.

- This small business relief options spreadsheet from Gusto: This is an ongoing list of funding options for small businesses, organized by state.

Tips for successfully applying for a loan for your childcare center

Not every loan application will be approved, so it’s important to take the time to increase your chances of approval. These tips will help you set yourself up for success as you begin your loan process!

Shop around for a lender

Childcare providers often stick with their primary bank for small business loans. While there are advantages to applying for loans through your usual bank, it’s not necessary!

If you have a great relationship with your bankers or you’ve had success in applying for loans from your usual bank in the past, it may make sense to apply with them again. However, many businesses have found that smaller banks and online lenders are more likely to approve their applications. Additionally, small banks and credit unions are used to working with small local businesses, so you may be able to get more face-to-face assistance and coaching from bankers there, whereas you may be waiting on the phone or in line for longer with a big bank.

Remember, in the case of PPP loans, only apply once!

Evaluate a few different lenders before deciding where to submit your application:

-

- Small local banks

- Credit unions in your area

- Nav, an online resource for small businesses that matches you with a lender

- Online lenders such as Funding Circle, Kabbage, Lendio, and BlueVine

To help you make your decision, read reviews of your lender online and learn about other businesses’ experiences in working with them. You can also find comparison charts, like this one from NerdWallet, which will help you determine which lender is right for you based on your business needs and your credit history.

Organize your paperwork and loan details in advance

Nothing is more frustrating for borrowers than having to pause their application process to go digging through files for a critical piece of paperwork! What’s more, if you don’t submit all required paperwork with your application or if you have errors, your application can be delayed or declined.

Before beginning any loan application, make sure you fully understand what paperwork will be needed. Gather your documents in a file so you don’t have to track them down later. If you work with an accountant, enlist their help to prepare your documents.

Lastly, be sure you’ve read and understand the details of the loan you’re applying for.

-

- How much? Make sure you’re applying for an appropriate and realistic amount. In many cases, it doesn’t pay to try to aim higher than needed.

- What are the terms? Is your loan forgivable, like PPP loans? If not, when will you have to pay it back, and at what interest rate? Is any collateral required?

-

- How will you track how you’ve spent the funding? Make sure you have a system in place to track your spending, and save all of your receipts and payroll data in a safe place for future reference.

If you have any unusual circumstances or outstanding questions, make sure to work with your lender or accountant to find the right answers. Don’t be shy or embarrassed—these professionals are there to help!

Be patient and persistent

A loan application can be an intense process! It’s okay to take the process in stages. Set realistic expectations for yourself—you don’t need to complete the entire process in a single day.

When you sit down to start your application, make sure you’re rested, hydrated, and in the right mindset. It may sound silly, but you’ll be far less likely to become frustrated or make mistakes if you’re feeling refreshed and ready for the task.

After applying, you may wait for days before hearing back. For example, PPP lenders have 10 days to process your loan. If you haven’t heard back from your lender after a week or two, it’s okay to reach out and check in.

If your loan application is declined, don’t lose heart! There will be more funding opportunities for you. Stay focused and continue to research your options. It helps if you understand why your application was declined so you can prepare better next time. For example, if you were declined because your credit score was too low, you can research lenders who work with borrowers with lower credit scores for future loan applications.

Continue to follow good financial practices

No matter how much funding you receive, it’s critical to be wise with cash flow these days! Keep your childcare business in good financial shape so your funding stretches farther.

Here are a few financial best practices for childcare centers and preschools in 2021:

-

- Be sure your tuition policy is fair to both your families and your business.

- It’s standard to continue charging tuition during holidays and emergency closures.

- Consider switching to collecting tuition online if you haven’t already so that you can get paid on time, without having to track down late payments or make trips to the bank. (Brightwheel users can use brightwheel billing to do this!)

Additional resources

Still have questions about funding for your childcare center or preschool? Explore these resources to help you find the funding you need.

- What’s the Difference Between a Grant and a Business Loan?

- Paycheck Protection Program 2.0: How to Apply for a New PPP Loan

- New Paycheck Protection Program (PPP) Loans: How to Qualify and Apply

- 8 Things You Can Do to Ensure Your PPP Application is Approved

- Types of Business Loans: Compare Your Financing Options

- What to Do if You Can't Get a Business Loan

- Small-Business Grants: Where to Find Free Money